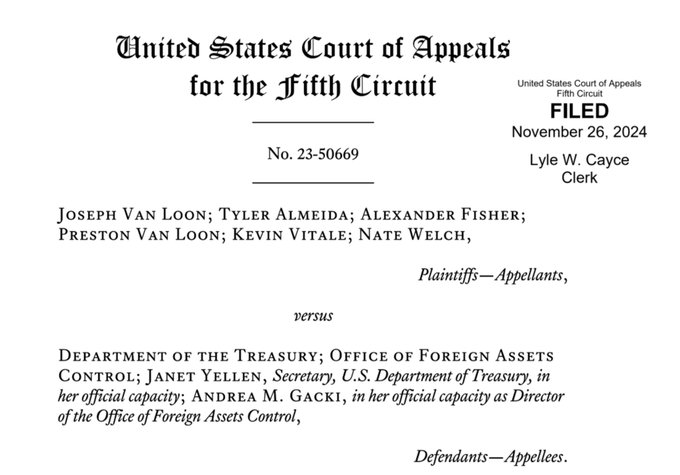

The Fifth Circuit Court of Appeals rules immutable smart contracts cannot be classified as “property,” marking a major milestone for crypto decentralization.

Court Rules Against Treasury’s Sanctioning of Tornado Cash

In a groundbreaking decision, the Fifth Circuit Court of Appeals overturned the U.S. Department of Treasury’s sanctions on Tornado Cash, ruling that the protocol’s immutable smart contracts fall outside the jurisdiction of federal law. The court determined that these autonomous and self-executing codes do not meet the legal definition of “property,” making them ineligible for regulation under the International Emergency Economic Powers Act (IEEPA).

Privacy wins. Today the Fifth Circuit held that @USTreasury’s sanctions against Tornado Cash smart contracts are unlawful. This is a historic win for crypto and all who cares about defending liberty. @coinbase is proud to have helped lead this important challenge. 1/6

This verdict has nullified OFAC’s controversial 2022 designation of Tornado Cash, a move that had previously drawn criticism from the crypto community for overreaching regulatory authority.

Victory for Crypto Privacy and Decentralization

Tornado Cash operates as a decentralized protocol on the Ethereum blockchain, enabling users to enhance transaction privacy through cryptographic techniques. Critics of the sanctions argued that penalizing open-source code rather than specific malicious actors threatened the foundation of decentralization and innovation in blockchain technology.

Coinbase CLO Paul Grewal celebrated the decision, calling it a pivotal moment for crypto privacy rights:

No one wants criminals to use crypto protocols, but blocking open source technology entirely because a small portion of users are bad actors is not what Congress authorized. These sanctions stretched Treasury’s authority beyond recognition, and the Fifth Circuit agreed. 3/6

Jake Chervinsky of Variant Fund echoed this sentiment, describing the case as a “stunning victory for crypto.” He emphasized that decentralization was key to the ruling, with the court rejecting the notion that autonomous smart contracts could be treated as property.

Industry Reacts to the Landmark Ruling

The crypto industry has hailed the court’s decision as a win for innovation and liberty. Notable figures, including Ethereum developers and DeFi leaders, have highlighted the implications of this case for the broader regulatory landscape. Hayden Adams, founder of Uniswap, remarked:

“Incredible the degree to which crypto is killing it in federal courts.”

holy shit

immutable smart contracts just beat the treasury department in court

“we hold that Tornado Cash’s immutable smart contracts (the lines of privacy-enabling software code) are not the “property” of a foreign national or entity, meaning (1) they cannot be blocked under…

While Tornado Cash’s token (TORN) surged by over 400% following the ruling, legal experts caution that the Treasury could escalate the case to the Supreme Court, potentially setting an even broader precedent for the future of crypto regulation.

Disclaimer:

The information provided on 13Desk is for informational purposes only and should not be considered financial advice. We strongly recommend conducting your own research and consulting with a qualified financial advisor before making any investment decisions. Investing in cryptocurrencies carries risks, and you should only invest what you can afford to lose. 13Desk is not responsible for any financial losses incurred from your investment activities.