A South Korean NH Bank manager allegedly siphoned millions through fraudulent loans to invest in crypto, later claiming losses.

NH Bank Manager Allegedly Embezzles Millions

A former loans manager from NH Bank, South Korea, faces accusations of embezzling $12.5 million. Reports suggest the money was funneled into cryptocurrency investments, only to result in significant losses. This case highlights ongoing concerns about internal controls within financial institutions.

Audit Reveals Fraudulent Loan Scheme

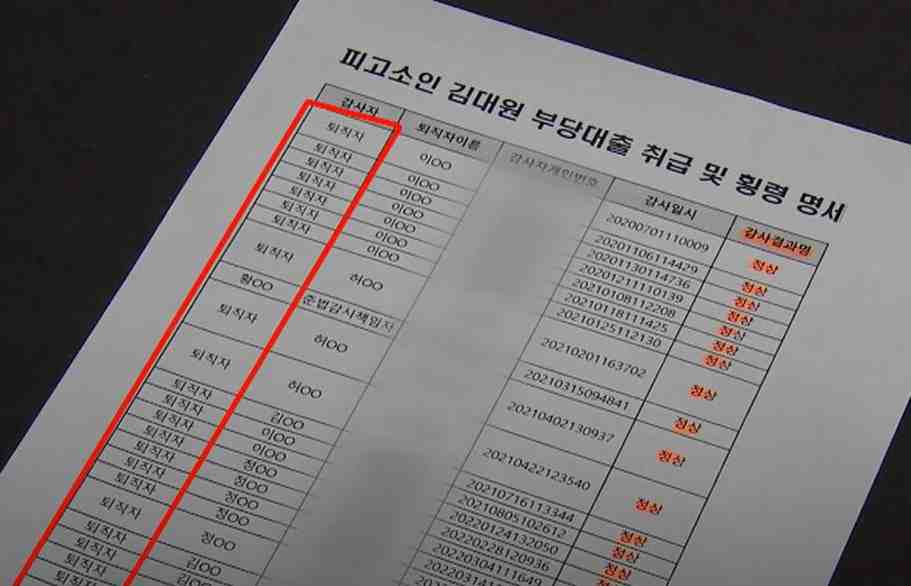

The bank discovered the irregularities during an internal audit conducted in August. The manager, identified as Kim, allegedly orchestrated fraudulent loans on 106 occasions over a span of four years, from June 2020 to August 2024. The audit, which detailed a suspicious flow of loans at a Seoul branch, unveiled Kim’s misuse of funds. According to the report, Kim used non-existent real estate as collateral to approve loans.

Statement From the Accused

In a public statement, Kim admitted to securing loans using fake real estate documents and investing the stolen funds in crypto. “I invested in crypto. But I lost everything, so I don’t have any money,” Kim stated, offering little hope for recovery of the stolen funds.

Bank’s Investigation Ongoing

NH Bank’s internal investigation revealed that $8.8 million of the stolen amount was acquired through illegal lending methods. The bank is expanding its probe to uncover the full extent of the theft and is also reviewing the actions of other employees.

We will resolve all problematic issues involved in this case. We will continue to improve our system to prevent a recurrence.

— A spokesperson from NH Bank

Calls for Improved Auditing Systems

The scandal has brought attention to NH Bank’s roving auditor system, which consists of former bank employees conducting internal audits. Critics argue that this setup lacks impartiality, leaving the institution vulnerable to fraud. Kang Jun-hyun, a South Korean lawmaker, has called for a review of the internal control systems to prevent similar financial crimes. “Financial accidents continue to occur. So the National Assembly will carefully examine the matter to ensure that internal control systems are in place,” Kang stated.

Similar Cases in the Industry

NH Bank is not the only financial institution facing such issues. Earlier this year, a former loan manager at Woori Bank, another major South Korean institution, was accused of embezzling $7.3 million. The stolen funds were also reportedly invested in cryptocurrencies, with the manager claiming substantial losses.

The trend of bank employees stealing funds for crypto investments points to the growing intersection of traditional banking and digital assets. While the promise of high returns may tempt some, the risk of significant losses remains high.

Financial Institutions Take Action

As crypto-related crimes rise, South Korean banks are tightening their internal procedures. However, the NH Bank scandal suggests that more stringent measures are needed to prevent future incidents. With growing pressure from lawmakers, banks must prioritize transparency and accountability to safeguard both their assets and reputation.

Crypto Risks Highlighted by Scandal

The NH Bank embezzlement case serves as a stark reminder of the risks associated with cryptocurrency investments, especially when funded through fraudulent means. While crypto markets can offer lucrative opportunities, they are equally prone to massive volatility and losses.

Disclaimer:

The information provided on 13Desk is for informational purposes only and should not be considered financial advice. We strongly recommend conducting your own research and consulting with a qualified financial advisor before making any investment decisions. Investing in cryptocurrencies carries risks, and you should only invest what you can afford to lose. 13Desk is not responsible for any financial losses incurred from your investment activities.