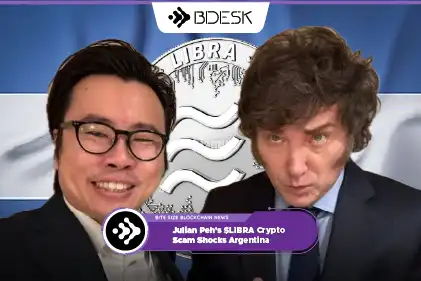

Tech entrepreneur Julian Peh faces accusations after $LIBRA’s collapse, sparking fraud investigations into investor losses and political fallout.

Julian Peh’s Rise in the Crypto World

Julian Peh entered the crypto space in 2016, initially investing in Bitcoin and Ethereum. By 2021, he profited from the NFT boom, flipping digital assets for quick gains. In 2024, he shifted focus to bigger opportunities, targeting Argentina’s emerging blockchain industry. This move set the stage for one of the largest crypto scandals in history.

Meeting President Javier Milei

Peh met Argentine President Javier Milei at a tech forum in Buenos Aires. They discussed artificial intelligence, small businesses, and Argentina’s economic future. Milei was impressed, offering Peh credibility with a handshake and a photo. This moment would later be used to promote $LIBRA as a government-backed project.

Thank you to the Government of the City of Buenos Aires @gcba for inviting us to the Blockchain Committee! It will be an honor to represent the artificial intelligence vertical on blockchain and work together for a more innovative future.

KIP Protocol and Government Influence

Months later, Peh’s company, KIP Protocol, joined Buenos Aires’ Blockchain Committee. This gave $LIBRA the appearance of an official government-endorsed token. Peh pitched $LIBRA as a national token to support small businesses and economic growth. Milei’s backing gave it legitimacy, attracting mass investor interest.

Julian met Milei (president of Argentina) at a tech forum in Buenos Aires He spoke about AI, small businesses, the future Milei was impressed A handshake. A photo. A promise. Julian had just secured something dangerous… 3/12

$LIBRA’s Explosive Launch

Milei posted on X: “The world wants to invest in Argentina.” His endorsement encouraged investors to join in, with $LIBRA reaching a $4B market cap in one hour. Investors believed they were funding Argentina’s future, not just a cryptocurrency. However, the token’s structure raised concerns among blockchain analysts.

Early Signs of a Scam

Bubblemaps revealed that 82% of $LIBRA’s supply was controlled by a single cluster. Experts warned of potential price manipulation, but the hype continued. As suspicions grew, insider wallets began dumping large amounts of tokens. Within hours, $87M vanished, triggering a market-wide panic.

The Collapse of $LIBRA

Retail investors saw their holdings plummet as the token’s value collapsed. People demanded answers, questioning who was profiting from the sudden crash. Milei deleted his promotional tweet, distancing himself from the project. This action shattered investor confidence, accelerating $LIBRA’s downfall.

Political and Legal Fallout

Critics labeled $LIBRA a “rug pull” designed to mislead investors for insider profit. Opposition politicians accused Milei of enabling financial fraud. Some warned that the scandal could lead to impeachment proceedings. In line with this, the Argentine president Milei urged for an investigation into the KIP protocol project.

Will There Be Accountability?

Authorities are examining whether Peh and his associates engaged in market manipulation. Milei’s government insists that he was also a victim of the scam. “The only one on the face of this earth who was cheated is Milei,” a government official claimed. Despite the controversy, Peh and his insiders walked away with millions.

Disclaimer:

The information provided on 13Desk is for informational purposes only and should not be considered financial advice. We strongly recommend conducting your own research and consulting with a qualified financial advisor before making any investment decisions. Investing in cryptocurrencies carries risks, and you should only invest what you can afford to lose. 13Desk is not responsible for any financial losses incurred from your investment activities.