Users allege an inside job, fueling debates about India’s largest crypto hack.

Hack Unveiled: WazirX’s July Scandal

On July 18, 2024, WazirX, India’s leading cryptocurrency exchange, faced a catastrophic hack. Approximately $235 million (₹2,000 crore) was siphoned from a consolidated wallet, initially attributed to the Lazarus Group from North Korea.

🚨 Convince me the WazirX hack was real! A thread 🧵 1/ Feb 2022: India announces a 30% crypto tax 💸 WazirX’s trading volume nosedives, and profits vanish overnight.

Despite early claims of external interference, a group of users, calling themselves “Justice for WazirX Users,” argue the breach could be an inside job. They point to a timeline of suspicious activities leading up to the incident.

A Troubled Timeline for WazirX

The problems for WazirX reportedly began with India’s introduction of a 30% crypto tax in February 2022. This caused a sharp decline in trading volumes and revenue.

In April 2022, the founders, Nischal Shetty and Siddharth Menon, relocated to Dubai, raising questions about their intentions. By August 2022, WazirX faced allegations of money laundering, leading to a freeze of $8 million by India’s Enforcement Directorate.

Tensions escalated when Binance severed ties with WazirX in January 2023. The ban on Binance in India in 2024 forced Indian users back to WazirX, centralizing significant funds in one vulnerable wallet.

Allegations and Financial Discrepancies

Post-hack investigations have exposed troubling inconsistencies in WazirX’s financial reporting. Users have raised concerns over unexplained expenses and liabilities, with $23 million categorized ambiguously as “Others.”

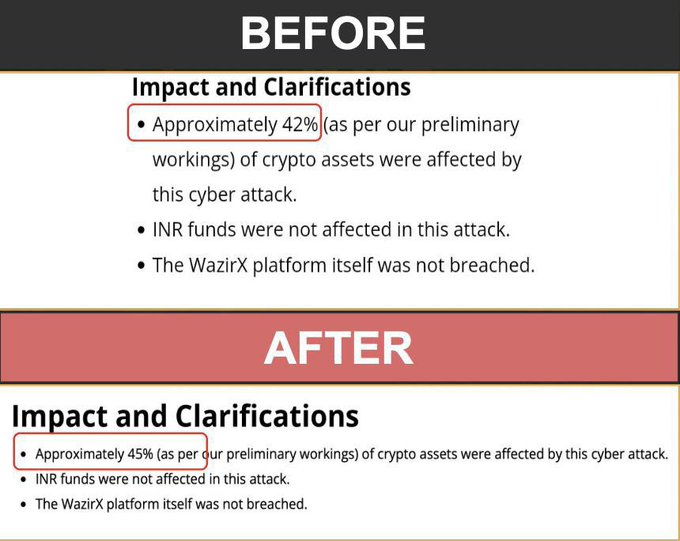

🚨 WazirX’s New Misleading Tricks Exposed! • Hacked on: 18th July ’24 • Initial Report: 42% of funds hacked • Latest Report: 45% hacked • Remaining 3% still being hidden! 🔹Users are left hoping for solutions, while WazirX seems more focused on grabbing the remaining…

In September, WazirX’s affidavit revealed discrepancies in the stolen fund totals and internal financial management. Critics argue this weakens user confidence and transparency.

WazirX’s Repayment Strategy

In response to mounting pressure, WazirX announced a plan to compensate creditors. This includes a 48% haircut on user funds and issuing Recovery Tokens for outstanding liabilities.

The platform has also proposed launching a decentralized exchange (DEX) to recover financially and restore user trust.

Legal Actions and Arrests

Legal battles have intensified. Rival exchange CoinSwitch has filed a lawsuit, alleging losses tied to the hack. Simultaneously, the Delhi Police have arrested suspects linked to the breach, including a man accused of selling fraudulent accounts.

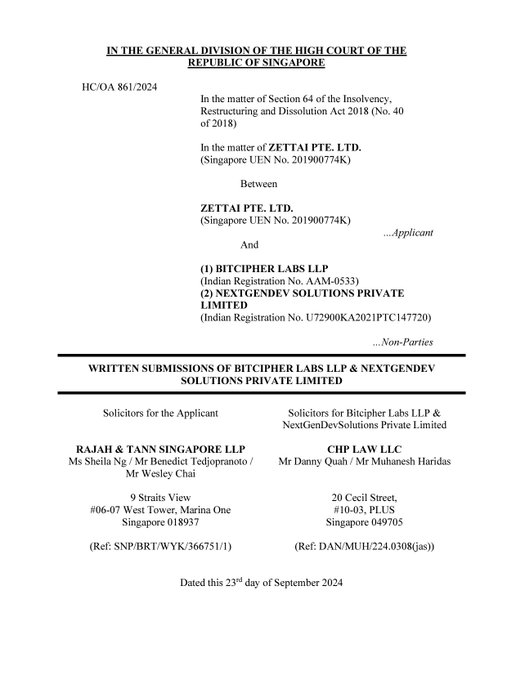

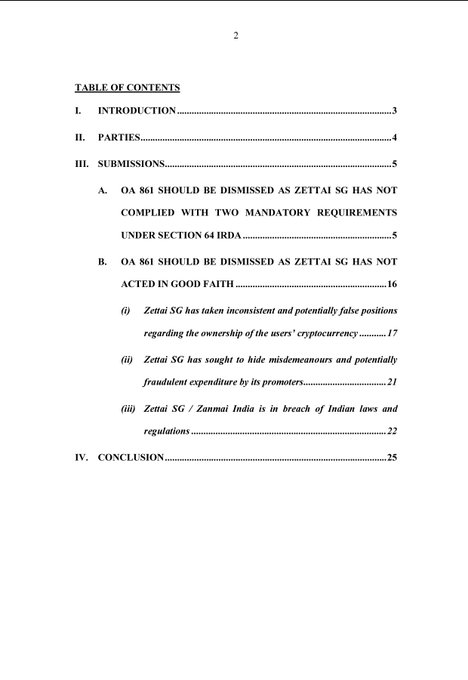

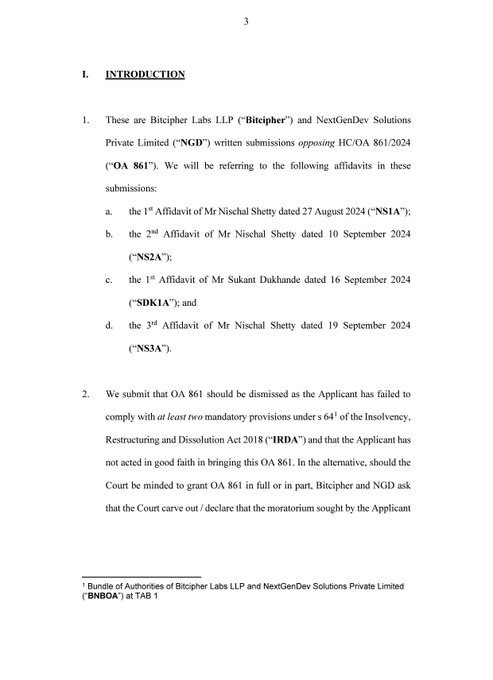

🚨Must read affidavit filed by CoinSwitch against #WazirX They claimed Zettai is attempting to conceal misconduct and potentially fraudulent expenditures by its promoters.

Systemic Challenges in Regulation

This incident highlights flaws in India’s crypto regulatory framework. Victims have criticized the slow response of regulatory authorities like the FIU and ED. With crucial decisions being made in Singapore courts, Indian users face a long wait for justice.

Disclaimer:

The information provided on 13Desk is for informational purposes only and should not be considered financial advice. We strongly recommend conducting your own research and consulting with a qualified financial advisor before making any investment decisions. Investing in cryptocurrencies carries risks, and you should only invest what you can afford to lose. 13Desk is not responsible for any financial losses incurred from your investment activities.