Vitalik Buterin suggests key adjustments to Ethereum’s staking and block production to enhance decentralization and security.

Addressing Ethereum’s Challenges

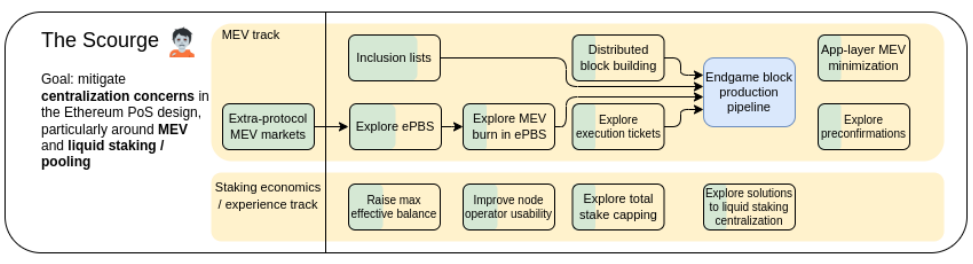

Ethereum co-founder Vitalik Buterin recently outlined solutions to tackle issues in Ethereum’s staking and block production. These concerns arise from centralization risks threatening the network’s integrity. In a post on October 20, Buterin highlighted how large staking pools diminish the diversity of smaller pools. He revealed that just two entities produced 88% of Ethereum blocks in early October.

Risks of Staking Centralization

Buterin labeled staking centralization as a significant risk to Ethereum. He warned that this could lead to transaction censorship and other crises. He noted, “One of the biggest risks to the Ethereum L1 is proof-of-stake centralizing due to economic pressures.” He indicated that 30% of the total Ether currently staked is sufficient to safeguard against 51% attacks. However, increased staking could pose additional risks.

Potential Solutions for Staking

To combat these issues, Buterin proposed capping the amount of Ether that any user can stake. He also suggested limiting staking penalties to a maximum of 12.5% of the staked Ether. These measures could be implemented through a two-tier system. This model would categorize staking into “risk-bearing” (slashable) and “risk-free” (unslashable) options.

Concerns Over Block Production

Buterin’s recommendations follow recent findings by Ethereum Foundation researcher Toni Wahrstätter. Wahrstätter noted that two builders, Beaverbuild and Titan Builder, dominated block creation in October. This specialization contributes to centralization, which Buterin warned could further compromise Ethereum’s performance.

The Proposal for Fork-Choice-Enforced Inclusion Lists

In response to the centralization issue, Buterin proposed the “fork-choice-enforced inclusion lists.” This strategy would allow proposers or stakers to choose transactions while builders would order them. This method enhances fairness in transaction selection and counters centralization trends.

Impacts on Transaction Speed

Buterin emphasized that the current state of block production could delay transaction processing. Without intervention, users may experience waits of up to 114 seconds for block inclusion, compared to the current six seconds. Such delays could facilitate sandwich attacks and lead to market manipulation during decentralized finance liquidations.

Exploring BRAID for Enhanced Decentralization

An alternative proposal by Buterin, called “BRAID,” aims to diversify block production. This approach would distribute tasks among various actors, each requiring moderate sophistication to maximize revenue. By diversifying responsibilities, Ethereum could minimize the risks of centralization and enhance its overall stability.

Looking Ahead: The Future of Ethereum

As Ethereum navigates its transition into the “Scourge” phase, these proposed adjustments could strengthen its resilience. Buterin’s insights aim to foster a more balanced ecosystem that encourages participation from diverse stakeholders. By addressing these pressing concerns, Ethereum can continue to thrive as a leading blockchain network.

Enhancing Ethereum’s Security and Decentralization

Buterin’s proposals serve as crucial steps toward enhancing Ethereum’s security and decentralization. By implementing these changes, the network can mitigate risks and maintain its position as a pioneer in blockchain technology. Stakeholders will need to collaborate to ensure these recommendations are effectively integrated into Ethereum’s ongoing development.

Disclaimer:

The information provided on 13Desk is for informational purposes only and should not be considered financial advice. We strongly recommend conducting your own research and consulting with a qualified financial advisor before making any investment decisions. Investing in cryptocurrencies carries risks, and you should only invest what you can afford to lose. 13Desk is not responsible for any financial losses incurred from your investment activities.