The largest crypto exchange by volume, Binance, faces challenges amid increased competition and regulatory scrutiny.

Decline in Binance Market Share

Binance, the largest cryptocurrency exchange, has experienced a significant decline in market share. During the tumultuous month of September, known as “Red September,” the exchange lost trading volume to its competitors. A report from CCData on October 3 indicates that Binance’s spot and derivatives trading volumes fell by 23% and 21%, respectively. Overall, centralized crypto exchanges saw a 17% drop in trading activity last month, which is a historical trend for September.

Current Market Standing

After the recent decline, Binance now holds a 27% market share in the spot market and 40% in derivatives trading. These figures reflect a regression to levels not seen since 2020. The exchange, founded by Changpeng Zhao, has faced intense scrutiny from U.S. regulators since the SEC filed a lawsuit against it in June 2023. This legal battle has resulted in significant changes within the company and increased pressure to comply with regulations.

Regulatory Challenges

Richard Teng now leads Binance following the departure of Zhao as CEO. Under Teng’s leadership, Binance has had to navigate numerous regulatory challenges. The SEC has accused the platform of operating as an unregistered brokerage and providing trading in illegal securities. These allegations have heightened concerns regarding Binance’s operational practices and its compliance with securities laws.

Rival Exchanges Gain Ground

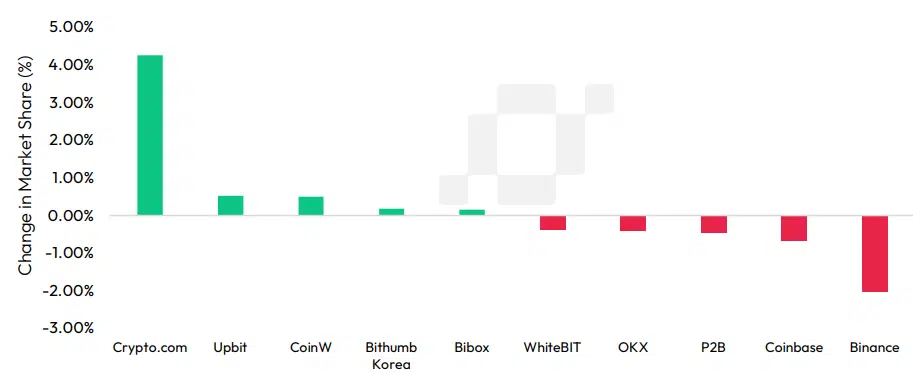

As Binance struggles, rival exchanges are seizing the opportunity to capture market share. According to CCData, Crypto.com has experienced a remarkable 40% increase in trading volumes across both spot and derivatives markets. This surge highlights how competitors have capitalized on Binance’s declining dominance.

Crypto.com’s Market Growth

Crypto.com has achieved significant growth this year, increasing its market share in the spot market by 8.08% to reach 10.5%. Other exchanges, including Bybit and Bitget, also reported gains. Bybit’s market share rose by 3.48% to 9.60%, while Bitget increased by 1.59% to reach 3.34%. This competitive landscape underscores the shifting dynamics within the crypto exchange sector.

Other Exchanges Losing Share

While Crypto.com and others thrive, Binance, Upbit, and OKX have suffered the most significant losses in market share. Binance’s share declined by 5.34%, Upbit’s by 4.60%, and OKX’s by 4.04%. Their current standings are 27.0%, 2.50%, and 3.91%, respectively. This decline raises questions about the long-term sustainability of these platforms amid evolving market conditions.

Looking Ahead

Market analysts anticipate a potential recovery in asset prices and liquidity as we approach the fourth quarter of the year. Expected cuts in Federal Reserve interest rates and developments related to the U.S. presidential election could contribute to market improvements. However, recent geopolitical tensions, particularly in the Middle East, have created uncertainty in the crypto markets.

Future Outlook

The crypto community is hopeful for a turnaround as regulatory clarity emerges. If the Federal Reserve implements further rate cuts, it could stimulate investor interest and increase trading volumes. The outcome of upcoming political events will also play a crucial role in shaping market sentiment.

Final Thoughts

Binance faces challenges amid increasing competition and regulatory scrutiny. The drop in market share highlights the need for the exchange to adapt and innovate. As the industry evolves, it will be essential for Binance and its rivals to navigate these changing dynamics to thrive in the future.

Disclaimer:

The information provided on 13Desk is for informational purposes only and should not be considered financial advice. We strongly recommend conducting your own research and consulting with a qualified financial advisor before making any investment decisions. Investing in cryptocurrencies carries risks, and you should only invest what you can afford to lose. 13Desk is not responsible for any financial losses incurred from your investment activities.