Summary:

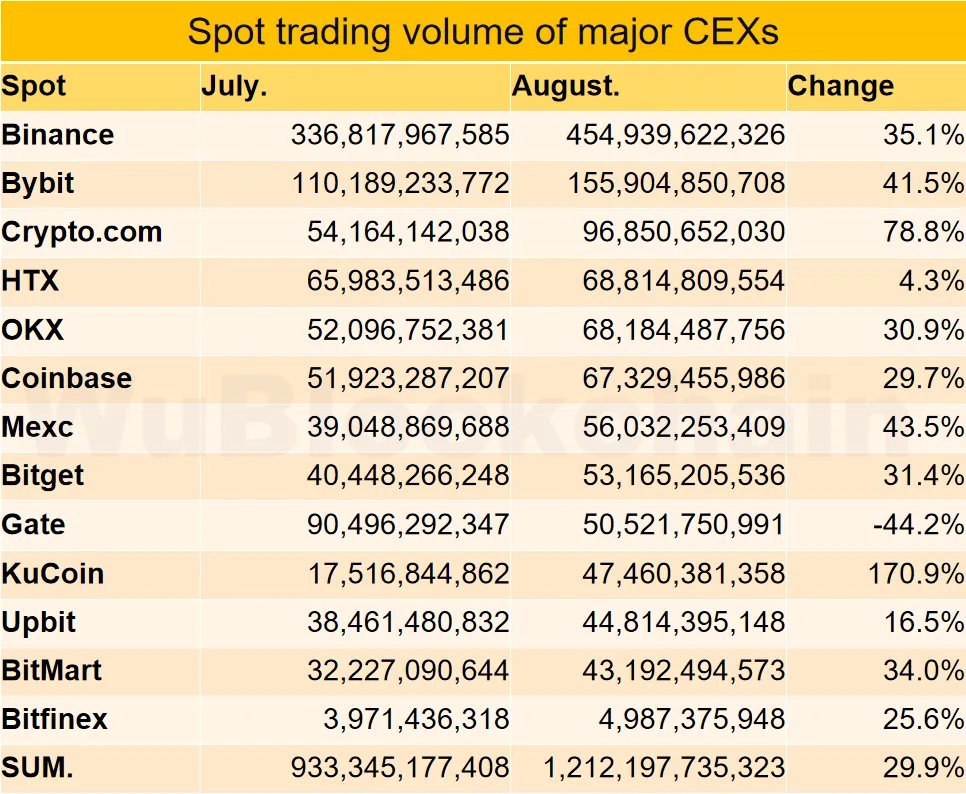

- Crypto Exchange Trading Volume: Binance, Bybit, and Gate.io report significant increases in trading volumes, driven by Bitcoin (BTC) and Ethereum (ETH) activity.

- Market Trends: The spike in BTC and ETH trading reflects renewed market confidence, despite regulatory pressures and global volatility.

- Safety and Security: With increasing trading activity, crypto enthusiasts are questioning which crypto exchange is safe for their assets.

Crypto Exchanges See Trading Volume Spike as BTC and ETH Lead the Charge

As the crypto market continues to evolve, the recent surge in trading volume across major exchanges like Binance, Bybit, and Gate.io highlights a growing interest in cryptocurrencies, particularly Bitcoin (BTC) and Ethereum (ETH). These leading exchanges are not only facilitating high-value transactions but also maintaining strong liquidity as crypto enthusiasts flock to invest in these top-tier digital assets.

Picture Source: Wu Blockchain Twitter

Binance, Bybit, and Gate.io: Leading the Pack in Trading Volume

Among the leading exchanges, Binance continues to dominate, with its BTC/USDT and ETH/USDT pairs accounting for a significant portion of the market’s overall trading volume. As the world’s largest crypto exchange, Binance offers a wide range of trading pairs, low fees, and extensive features that cater to both novice and advanced traders.

Bybit, known for its derivatives market, has also experienced a surge in trading volume. Bybit’s focus on perpetual contracts and margin trading has made it a popular platform for traders looking to capitalize on market movements in BTC and ETH. The exchange recently expanded its offerings to include spot trading, further enhancing its appeal.

Meanwhile, Gate.io, with its vast selection of altcoins, is seeing its share of increased activity. The exchange supports both spot and futures trading, providing a robust platform for investors looking to diversify their portfolios beyond just BTC and ETH.

What Is Crypto Exchange Trading Volume?

Crypto exchange trading volume refers to the total amount of a specific cryptocurrency traded on a platform within a given timeframe, usually measured daily or weekly. This figure indicates the exchange’s liquidity and the popularity of specific assets.

When trading volume spikes, it often signals heightened investor interest and confidence in the market. High volume ensures better price stability, allowing traders to execute large trades without significant price changes, which is particularly important in a volatile market like crypto.

Binance, Bybit, and Gate.io: Leading the Pack in Trading Volume

Among the leading exchanges, Binance continues to dominate, with its BTC/USDT and ETH/USDT pairs accounting for a significant portion of the market’s overall trading volume. As the world’s largest crypto exchange, Binance offers a wide range of trading pairs, low fees, and extensive features that cater to both novice and advanced traders.

Bybit, known for its derivatives market, has also experienced a surge in trading volume. Bybit’s focus on perpetual contracts and margin trading has made it a popular platform for traders looking to capitalize on market movements in BTC and ETH. The exchange recently expanded its offerings to include spot trading, further enhancing its appeal.

Meanwhile, Gate.io, with its vast selection of altcoins, is seeing its share of increased activity. The exchange supports both spot and futures trading, providing a robust platform for investors looking to diversify their portfolios beyond just BTC and ETH.

Disclaimer:

The information provided on 13Desk is for informational purposes only and should not be considered financial advice. We strongly recommend conducting your own research and consulting with a qualified financial advisor before making any investment decisions. Investing in cryptocurrencies carries risks, and you should only invest what you can afford to lose. 13Desk is not responsible for any financial losses incurred from your investment activities.