Experts warn of potential market shakeout as funding rates soar and Bitcoin dominance declines.

Altcoin Season: A Looming Shakeout?

The altcoin market has experienced a strong rally following Donald Trump’s U.S. presidential victory, but a potential downturn may be on the horizon. Felix Hartmann, managing partner at Hartmann Capital, cautioned traders about a possible near-term “ugly leg down” driven by aggressive profit-taking by venture capitalists (VCs).

Rising Risks in the Altcoin Market

Hartmann highlighted that most altcoin funding rates have surged past 100% annualized, signaling that perpetual traders are driving recent moves amid decreasing spot volumes.

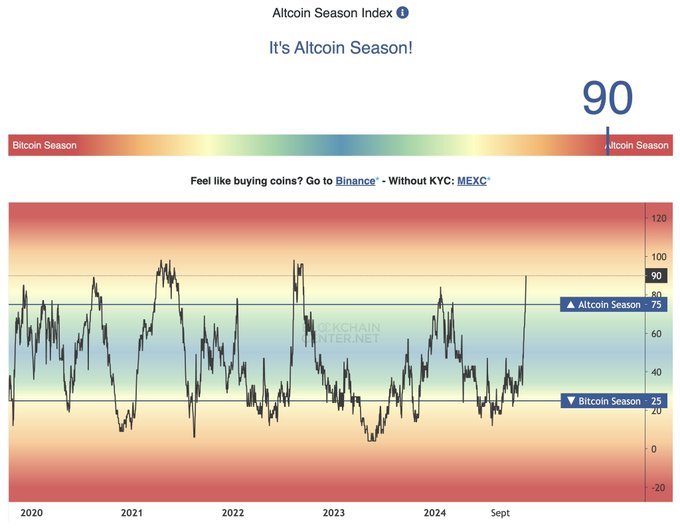

#ALTSEASON lasts about 90 days From this month till March seems logical.

“Once momentum tips, we’ll see some murder wicks,” Hartmann said, implying a sharp decline that could catch traders off guard.

In past cycles, similar scenarios have resulted in steep declines. For instance, during the 2021 altcoin rally, assets like Solana (SOL) and XRP saw significant crashes within months of reaching their peaks.

Contrasting Opinions on Altcoin Season

Not everyone agrees with Hartmann’s bearish outlook. Some traders remain optimistic about the ongoing altcoin season. Pseudonymous trader Mikybull Crypto predicted altseason could extend until March, while Sensei, another popular trader, declared, “Altseason has just started.”

Considering alt season tapped out for now. Most alts now have funding rates north of 100% annualized. Last moves purely perp driven, spot volumes declining. Leg down will be ugly. Doing some light 2x long BTC, 1x short tapped out dino coins Traders may stay irrational,…

Key Market Indicators

Bitcoin dominance, often used as a barometer for altcoin season, has dropped to 55.11%, down by 7.88% over the past 30 days. However, elevated funding rates for perpetual futures could pose risks, especially if prices stabilize or decline, as traders might struggle to maintain their leveraged positions.

What Lies Ahead?

The altcoin market stands at a critical juncture. While bullish sentiment persists among some traders, Hartmann’s warning serves as a cautionary note for those betting on prolonged gains. Investors must monitor market trends, Bitcoin dominance, and funding rates closely to navigate the volatility ahead.

Disclaimer:

The information provided on 13Desk is for informational purposes only and should not be considered financial advice. We strongly recommend conducting your own research and consulting with a qualified financial advisor before making any investment decisions. Investing in cryptocurrencies carries risks, and you should only invest what you can afford to lose. 13Desk is not responsible for any financial losses incurred from your investment activities.