The crypto market’s bullish run continues as Bitcoin surges, pushing the sentiment into the “greed” territory.

Crypto Sentiment Turns Greedy as Bitcoin Climbs

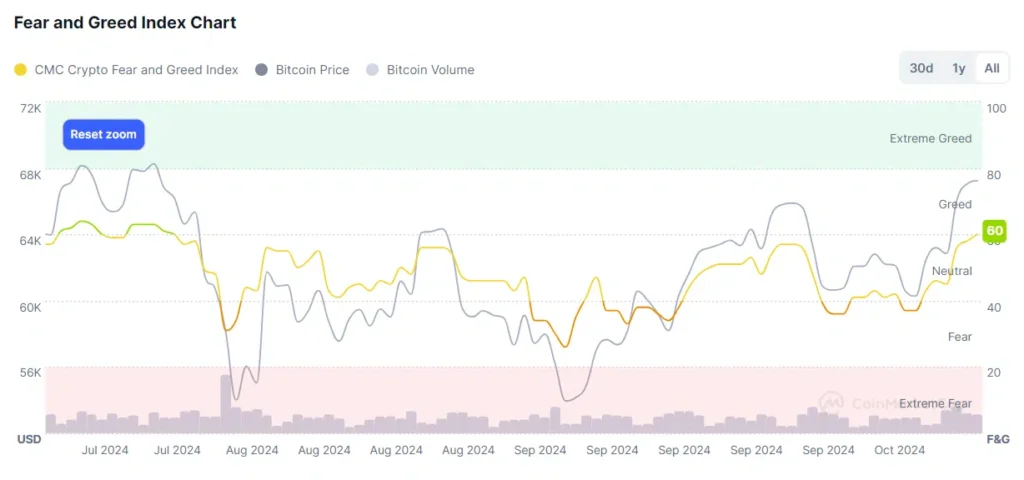

The cryptocurrency market has witnessed a significant shift in sentiment, with Bitcoin’s ongoing rise fueling optimism. The crypto fear and greed index, which tracks market emotions, entered the “greed” zone today, reaching a score of 60, indicating a growing positive outlook for investors. The index reflects rising confidence as digital assets continue their bullish trend.

Bitcoin Leads Market Recovery

The market’s current momentum can be attributed primarily to Bitcoin’s performance. Following a significant dip in early August when BTC fell below $54,000, the leading cryptocurrency has staged a strong recovery. Since October 10, Bitcoin has recorded a 12% increase, briefly touching a two-month high of $68,375 on October 16. Despite a slight correction, Bitcoin remains up 0.3% over the last 24 hours, currently trading at $67,350.

Profitable Positions Increase as Bitcoin Holds

Data from IntoTheBlock shows that 95% of Bitcoin holders are now in profit, with only 3% close to breaking even, and 2% seeing losses. With the majority of holders in a profitable position, short-term profit-taking could become a common trend. The number of daily active addresses in profit, however, decreased slightly, falling from 112,780 to 91,160 between October 15 and 16.

Spot ETFs Driving Demand

One of the main catalysts for Bitcoin’s bullish momentum is the increased demand for spot Bitcoin exchange-traded funds (ETFs) in the U.S. According to a crypto.news report, these ETFs saw a net inflow of over $1.6 billion in the last four days alone, with $458.5 million added on October 16. This growing interest in Bitcoin ETFs has driven more investment into the cryptocurrency, further supporting its upward trajectory.

Short-Term Profit-Taking vs. Long-Term Gains

Though Bitcoin’s rise has prompted many holders to consider short-term gains, some investors appear to be holding out for further price increases. The recent decrease in active wallets taking profits suggests that many expect Bitcoin to continue its climb. Despite the current market sentiment moving toward “greed,” many market participants are maintaining a long-term view.

Conclusion: Sustained Momentum or Temporary Greed?

While Bitcoin’s recent surge and the overall shift to greed in the market suggest optimism, it’s important to recognize that profit-taking and corrections could temper this momentum. Investors are watching closely to see whether Bitcoin will continue its upward trend or if market sentiment will shift again.

Disclaimer:

The information provided on 13Desk is for informational purposes only and should not be considered financial advice. We strongly recommend conducting your own research and consulting with a qualified financial advisor before making any investment decisions. Investing in cryptocurrencies carries risks, and you should only invest what you can afford to lose. 13Desk is not responsible for any financial losses incurred from your investment activities.