Indodax, one of Indonesia’s leading crypto exchanges, suffered a $22 million hack, raising concerns about crypto security and regulations.

Major Crypto Hack Hits Indonesia’s Leading Exchange Indodax

Indonesia’s crypto industry has taken a significant hit with the recent hack of Indodax, one of the country’s most prominent cryptocurrency exchanges. The breach, which resulted in a loss of approximately $22 million, has raised many questions about the security of crypto exchanges and the legal framework governing digital assets in Indonesia. As the public grapples with the consequences of the hack, questions like is crypto legal in Indonesia and how secure are Indonesia’s crypto exchanges have come to the forefront.

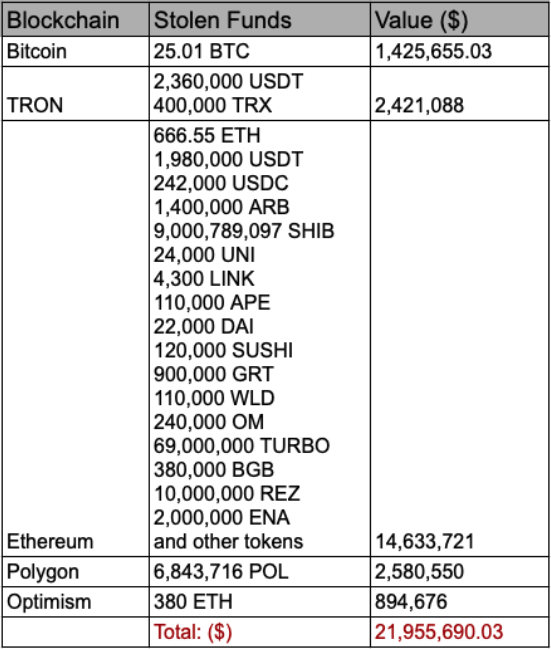

The hack was first reported on Sept. 11, when blockchain analytics firm SlowMist flagged suspicious activity on Indodax’s hot wallets. In a detailed post on social media, the firm revealed that the hacker had withdrawn millions from the exchange. Indodax, which holds a reserve balance of $369 million, according to CoinMarketCap, quickly acknowledged the breach and suspended its services to investigate the incident. This breach highlights potential vulnerabilities in the crypto exchange’s infrastructure, and investigations are still underway to determine how the hacker accessed the funds.

Picture Source: Slow Mist’s Twitter

Indodax Confirms Hack After Widespread Speculation

Once news of the attack spread across social media, Indodax confirmed that its platform had been compromised. The exchange stated that both its mobile and web applications were temporarily disabled to protect its users and allow time for a full investigation. Crypto exchanges like Indodax play a crucial role in the growing crypto economy in Indonesia. With over 4.3 million registered users, Indodax is one of the country’s largest and most trusted platforms, making the incident a major blow to Indonesia’s crypto industry.

According to blockchain data from SlowMist and Cyvers, the hacker managed to withdraw over $22 million in various cryptocurrencies from the exchange’s hot wallets. The stolen assets included $1.42 million in Bitcoin, $2.4 million in Tron (TRX), and over $14.6 million in ERC-20 tokens. Ethereum (ETH) and Polygon (POL) tokens were also targeted, with significant amounts siphoned from the Optimism blockchain.

Picture source : Indodax Twitter

How Did the Hack Happen? Investigations Begin

Blockchain security firm SlowMist, which was the first to report the incident, suggested that the breach occurred through Indodax’s withdrawal system. This system allowed the hacker to gain access to the exchange’s hot wallets and withdraw funds. Another firm, Cyvers, reported over 150 suspicious transactions that took place across multiple blockchain networks. The hacker quickly converted stolen tokens into Ethereum (ETH) and, as is often the case in major crypto hacks, began using crypto mixing services like Tornado Cash to obscure the origins of the funds.

While crypto hacks are not uncommon globally, the sheer size of this breach has brought attention to the security measures that Indonesia’s crypto exchanges employ. Despite being one of the largest crypto exchanges in Southeast Asia, Indodax’s security flaws now raise doubts about the overall strength of crypto exchanges operating in Indonesia.

The Legal Status of Crypto in Indonesia

The hack has also reignited the debate over whether crypto is legal in Indonesia. The country has been taking steps to regulate cryptocurrency activities, though its legal framework is still evolving. Indodax, founded by Oscar Darmawan and William Sutanto in 2014, is fully licensed and operates under the oversight of Indonesia’s Commodity Futures Exchange Supervisory Board (Bappebti). The exchange also holds certifications from the Ministry of Communication and Information of Indonesia, affirming its compliance with existing crypto regulations.

Disclaimer:

The information provided on 13Desk is for informational purposes only and should not be considered financial advice. We strongly recommend conducting your own research and consulting with a qualified financial advisor before making any investment decisions. Investing in cryptocurrencies carries risks, and you should only invest what you can afford to lose. 13Desk is not responsible for any financial losses incurred from your investment activities.